This article was originally posted on www.ibuynew.com.au

If you’ve been thinking about buying, now really is an opportune time to either purchase your first home or investment property. There are some BIG incentives on offer with the different federal/state government grants, schemes and rebates currently available.

What grants, rebates and schemes are available to you?

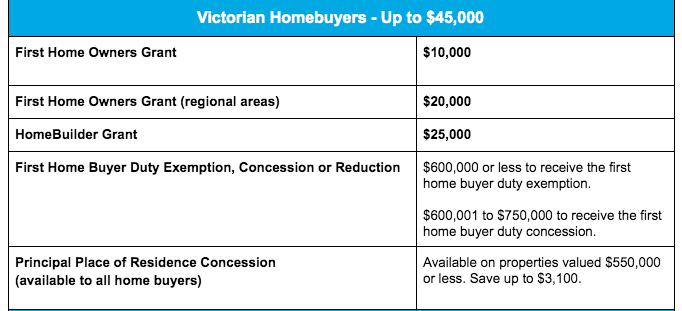

Whether you are in the market to buy your first, second or third property, there are potential savings to be had no matter what state you live in. From the First Home Owners Grant to the First Home Loan Deposit Scheme, to the newly launched HomeBuilders Grant or Stamp Duty concessions. The rules and benefits change from state to state, so it’s important to check eligibility criteria before you start factoring these incentives into your budget.

Not sure where to start? For your convenience, we’ve compiled all the information for you, right here in this article.

First Home Owners Grant (FHOG)

The First Home Owners Grant is available to first-time buyers Australia wide. The Grant varies in value from $10,000 and up to $20,000 in some regional parts of the country. First home buyers must meet certain criteria to be eligible for the Grant and property price caps vary from state to state. Visit the link for more information on the First Home Owners Grant in your state or territory.

First Home Loans Deposit Scheme (FHLDS)

This scheme was put in place to allow first home buyers the opportunity to get into the property market sooner. It allows First Home Buyers to purchase their first home with a deposit of as little as 5%. The Government guarantees the remaining 15% allowing first home buyers to avoid mortgage insurance. The Scheme was launched at the beginning of this year and has proved to be very popular. Only 10,000 places have been made available for the FIN 20/21.

Read our article What is the First Home Loan Deposit Scheme for more information on FHLDS and who is eligible to apply. You can also take a look at the Australian Government’s fact sheet for further details.

First Home Super Saver Scheme (FHSSS)

Allows first home buyers to make up to $30,000 in voluntary contributions to their superannuation fund to save for a home, with a limit of 15,000 per financial year. According to the Treasury’s website, the scheme could boost the savings most people can put towards a deposit by at least 30% compared to saving through a standard savings account. For more information on this scheme visit the Treasury website.

The HomeBuilder Grant

The newly launched HomeBuilders Grant is available to Australian citizens who meet the eligibility criteria. The $25k grant is available up until the 31st of December this year and has been offered on top of existing grants and schemes (state and federal). It can be used for both newly built properties or new renovations to existing dwellings. Read our article for more information on the HomeBuilder Grant and who is eligible.

Please note: the Morrison government recently extended the HomeBuilder Grant for a further 3 months. Those applying for the HomeBuilder Grant between the 1st Jan until the 31st March 2021 will be eligible for a lesser payment of $15,000. However, the property caps have been raised in VIC and NSW.

Stamp Duty Concessions (also known as Transfer Duty)

Buyers may also be eligible for various stamp duty rebates and concessions, some apply to First Home Buyers and Seniors holding concession cards only. There are also Stamp Duty concessions for anyone purchasing off-the-plan properties in some states. Check your local state or territory revenue office website for further details on Stamp Duty rebates and savings. Another good place to start is to use an online Stamp Duty Calculator.

How do the states add up?

The range of benefits available varies from state to state. Western Australians come out on top (at the moment) with the choice of incentives available to homebuyers, with first home buyers being the biggest winners. Below is a list of the grants and schemes offered by both the state and federal governments by state (excluding stamp duty exemptions & concessions).

Please note that each of these incentives is bound by eligibility criteria. To see if you qualify for any of the available incentives offered in your state of residence, make sure you check with the relevant state or territory revenue office.

Here is a list of all State and Territory websites:

VIC, NSW, QLD, SA, WA, TAS, ACT, NT

WA: Refer to the State Revenue Office’s calculator and website for more information.

VIC: For more information regarding FHB Duty Exemption, Concession or Reduction, visit the State Revenue Office’s website.

For more information regarding PPR Concession, visit this website.

TAS: Further information on duty concession for FHB’s – visit this website. Further information on duty concession for pensioners – visit this website.

QLD: Further information about Home Concession, First Home Concession, and First Home Vacant Land Concession.

For more information regarding the First Home Buyer Assitance Scheme (NSW), visit this website.

Looking to take advantage of one or more of these incentives on offer in your state?

Now is the perfect time. Get in touch with one of our new home advisors at iBuildNew to discuss your options.

- We’ll ask the right questions to better understand your needs

- We’ll create a recommended shortlist ideally matched to you

- We’ll answer specific questions or concerns related to home building, land purchasing or financing